Blog

Let Us All Help Our Friends, Relatives And Neighbours Get Back To Normality...

As Covid Restrictions ease and we return to a new type of normality I would ask everyone to make a special effort in looking out for older relatives, neighbours, and friends....

Read More

The Fair Deal Scheme Ireland Positive Change’s for Farming & Business Families...

The long wait is finally over for farming and business families seeking the Fair Deal Scheme in Ireland now that the Nursing Homes Support Scheme (Amendment) Bill 2021 is finally passed by Mary Butl...

Read More

Welcome changes to the Fair Deal finally passed by Dail & Seanad...

At long last the changes to the Fair Deal Scheme that will cap qualifying Farming and Business applicant’s contribution on their land and business values to 3 years were finally passed by the Dail a...

Read More

Are you or your Relative overpaying for your Nursing Home care?...

Due to lack of advice when entering the Fair Deal/Nursing Home Support Scheme I estimate that over 90% of all applicants end up overpaying for their long- term care under the Fair Deal Scheme....

Read More

Fair Deal Ireland Nursing Homes Support Scheme Guide – When Do You Need A Care Representative ...

I know I keep saying this too often that as you age, you should consider taking out an Enduring Power of Attorney. This is vital for you as your nominated Attorneys will be able to make financial deci...

Read More

3 Year Exemption For Farmland And Businesses To Be Introduced Shortly...

Good news for Farmers and Business Owners. The legislation introducing the exemption of Farmland and Businesses after 3 years from the Fair Deal asset assessment is due back in the Dail in the next ...

Read More

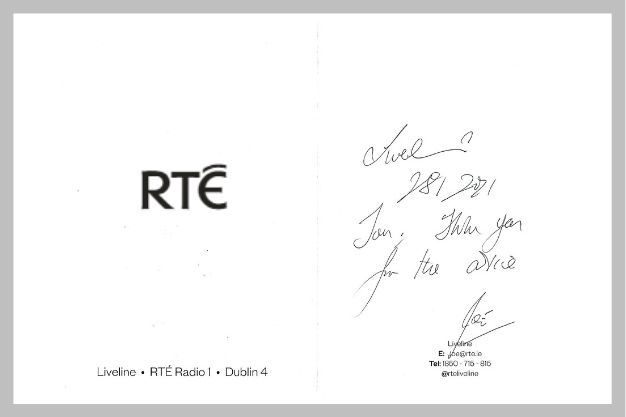

Nice to get this thank you card from Joe Duffy for the advice I gave on Life Loans on his Radio show...

Nice to get this thank you card from Joe Duffy for the advice I gave on Life Loans on his Radio show last week....

Read More

Fair Deal Advice Founder Tom Murray Was Recently Featured on Liveline – Talking About Life Loa...

Great to be asked to be part of the Joe Duffy show today contributing on the subject of Life Loan. It is very distressing seen how these impact older people their fair deal applications and ultimately...

Read More